:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2188256134-5d824e1c4d044068ad1b8156be430d10.jpg)

Key Takeaways

- The Federal Reserve’s plans for interest rate cuts in 2025 are up in the air as officials wait to see what policy President-elect Donald Trump will impose and what effect it has on the economy.

- In particular, Trump’s plans to impose tariffs have raised eyebrows at the central bank because they could push up inflation.

- The year ahead could bring conflict between Trump and Fed Chair Jerome Powell, who has resisted Trump’s suggestion that the president should have a say in monetary policy decisions.

No one knows quite what to expect from the Federal Reserve in 2025, least of all officials at the Fed itself.

After cutting interest rates three times in as many meetings, the Fed is entering a new phase in its fight against inflation as it goes into 2025. The Fed is waiting to see what will happen with inflation, whether incoming President Donald Trump will impose heavy tariffs, and what effect those tariffs will have on the economy. That’s not to mention changes to tax policy, regulations, and many other factors that might change as the government switches over to Republican control in January.

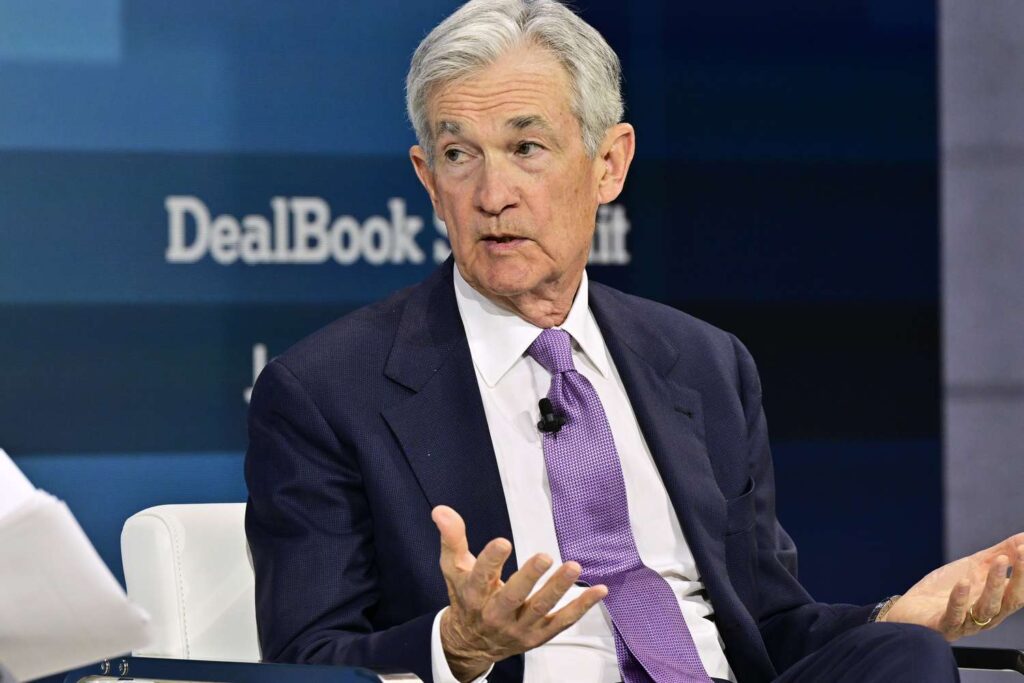

Chair Jerome Powell used the words “uncertain” or “uncertainty” 14 times during a press conference following the Fed’s most recent policy announcement in December.

“The uncertainty is just a function of the fact that we expect significant policy changes,” he said. “There’s nothing really unusual about that. I think we need to see what they are and see what the effects they will have.”

Inflation Remains Stubborn and Trump Proposals Likely Won’t Help

At least one thing is still certain: inflation remains above the Federal Reserve’s annual goal of 2%, rising by 2.4% by the Fed’s preferred measure. Next year, the Fed will try to bring that down while preventing a severe unemployment rise.

Accomplishing both of those goals is a balancing act because the Fed’s main tool is manipulating the federal funds rate, which influences borrowing costs on all kinds of loans. A higher fed funds rate can slow the economy and reduce inflation but it could also damage the job market.

The Fed lowered the fed funds rate from a two-decade high in September and, over the course of three meetings, reduced it by an entire percentage point. Central bankers expect more cuts next year but at a much slower pace. According to Fed officials’ latest round of economic projections, they anticipate lowering their benchmark rate by just three-quarters of a percentage point all year.

Of all the potential changes brought by the new presidential administration, the Fed has paid special attention to tariffs. Trump said he would impose high import taxes on U.S. trading partners, but the details of the plan are unclear.

Economists said tariffs could stoke inflation as merchants pass costs along to their customers. It could also slow the economy and reduce employment, complicating the Fed’s goal of stabilizing both price increases and unemployment.

Trump Vs. Powell, Round 2?

The new year may also bring a political clash between the Fed and the White House.

Trump frequently criticized Powell during his first presidency, attacking him for keeping interest rates higher than Trump would like. Although Trump has said he would not try to fire Powell before his term ends in 2026, he has said he would like to have more influence over the central bank’s policy decisions.

Powell has pushed back against that idea, maintaining that the Fed is more effective the farther removed it is from direct control by politicians.