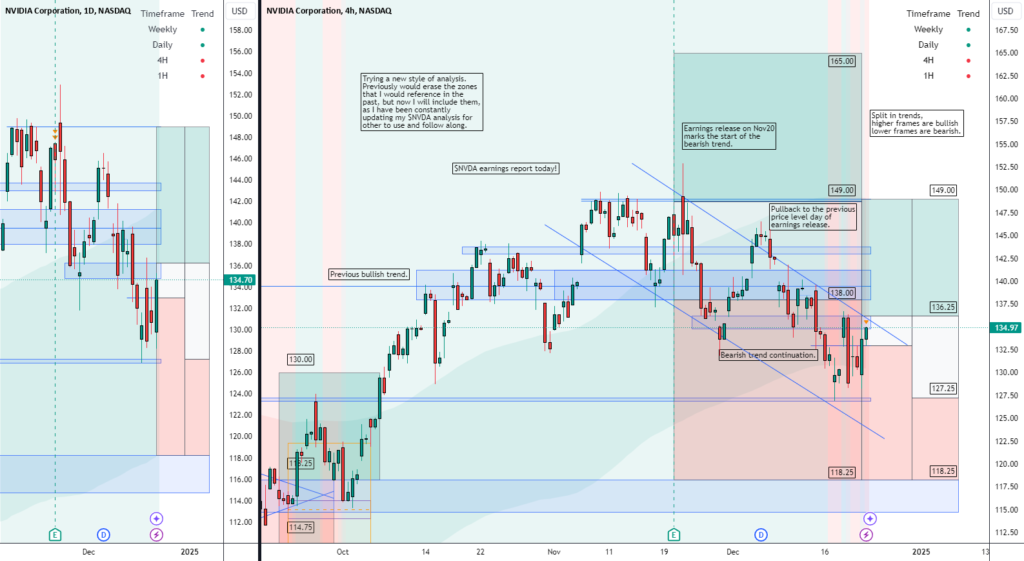

NVDA BUY/LONG ZONE (GREEN): $136.25 – $149.00

NVDA DO NOT TRADE/DNT ZONE (WHITE): $133.00 – $136.25 (can be extended to $127.25 – $136.25)

NVDA SELL/SHORT ZONE (RED): $118.25 – $133.00 (can be extended to $118.25 – $127.25)

NVDA Trends:

NVDA Weekly Trend: Bullish

NVDA Daily Trend: Bullish

NVDA 4H Trend: Bearish

NVDA 1H Trend: Bearish

NVDA stock has been in a downtrend since their last earnings release on Nov20, who will become the next trillion-dollar chip maker? Trying a new style of analysis. Previously would erase the zones that I would reference in the past, but now I will include them, as I have been constantly updating my NVDA analysis for other to use and follow along. After we saw the fall from the Nov20 earnings report, price pulled back to the previous price level the day of earnings release, before tumbling back into the bearish zones. The down trend has not been broken for NVDA, but bulls should look for a break above 136.25 and bears should look for continuation below 133.00 or 127.25.

I will link below my previous NVDA analysis, along with my SMCI analysis and AMD analysis!

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, fed, federalreserve, fedrate, fedratecut, interestrate, jeromepowell, fedchair, 50bps, volatile, volatility, nvidia, nvidiapricetarget, nvdatrend, nvidiatrend, nvdasetup, nvidialongs, nvidiashorts, chipmakers, smci, amd, supermicro, advancedmicro, chipmakertrends, newchipmakers, trilliondollarchipmakers, nvidiaproducts, nvidiachips, nvdachips, nvdatrend, nvdaprice, nvidiaprice, nvidiaanalysis, nvidiasetups, nvdaideas,