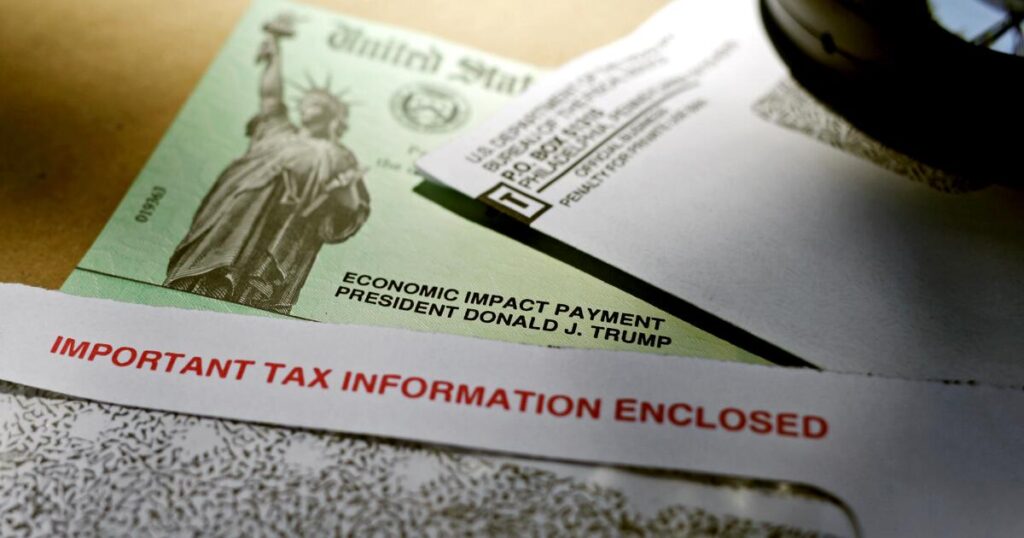

Everyone’s favorite Christmas gift giver, the Internal Revenue Service, has announced that it will be doling out more than $2 billion in checks to Americans this month as part of its effort to make sure everyone received their stimulus payments from 2021.

The federal tax agency has announced that an internal review showed many Americans had never received their economic impact payments, which were supposed to go out following the filing of 2021 tax returns. Because of this, the agency is paying out the money they still owe Americans who never received their checks.

Although most eligible Americans received their stimulus payments, the checks will be sent to those who qualified but filed a 2021 tax return that left the space for recovery rebate credit blank.

Those people are eligible for up to $1,400 from the federal government. The payments should be received by late January 2025, at the latest.

“These payments are an example of our commitment to go the extra mile for taxpayers. Looking at our internal data, we realized that 1 million taxpayers overlooked claiming this complex credit when they were actually eligible,” said IRS Commissioner Danny Werfel. “To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic, meaning these people will not be required to go through the extensive process of filing an amended return to receive it.”

Stimulus payments of $1,400 were sent out to Americans as part of a $1.9-trillion COVID-19 relief bill. Millions of Americans were eligible for the payments.

To get a check, Americans were required to make less than $75,000 per year or under $150,000 as a household.