The incoming US presidential administration is likely to build on the use of export controls to hinder China’s access to advanced technologies and maintain the United States’ technological primacy. Its success will depend in part on persuading allies to help.

Trump has signaled that his second term will again feature protectionist, economic security-focused foreign policy. An indication of that continuity is his nomination of Jameson Greer as US trade representative, Robert Lighthizer’s former chief of staff.

The returning president’s approach to trade is likely to target critical sectors that underpin both military and dual-use applications, such as artificial intelligence, quantum computing, biotechnology, and energy-related technologies. As part of this broader technological industrial strategy, critical minerals and renewables could increasingly become targets of regulation, especially due to their growing importance in the clean energy transition and competition with China. This could affect Australian interests.

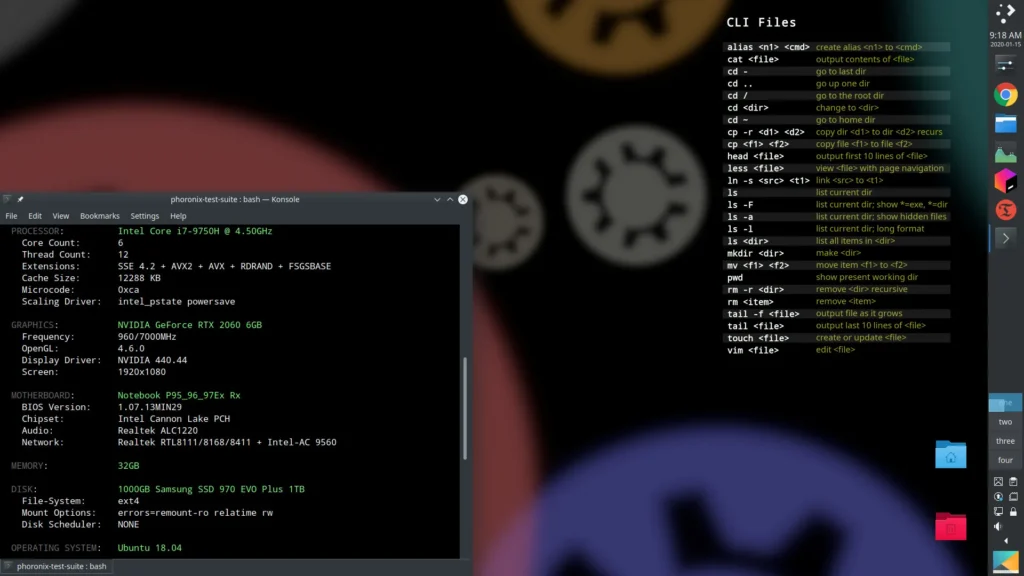

The US has increasingly sought to bolster its export control regime since Barack Obama launched the Export Control Reform Initiative in 2010, streamlining the regulatory process to focus agencies’ attention on items of greatest concern. Trump continued this approach more assertively, with the Export Control Reform Act of 2018 establishing a new permanent statutory basis for export controls. The act also created an interagency process to identify and impose additional restrictions on emerging and foundational technologies critical to US national security.

The US often exerts influence over global supply chains by exercising export controls unilaterally. For example, the Trump administration’s expansion of the Foreign Direct Product Rule restricted Huawei’s access to US semiconductor designs and finished chips, even if they were manufactured abroad using US-origin technology. The administration thereby effectively embargoed Chinese access to some critical technologies.

In addition to tightening US export controls on entities of concern, the Trump administration also encouraged partner countries to comply with existing regulations enforced through multilateral export control lists. For example, it persuaded the Dutch to enact domestic regulations that prevented ASML from selling advanced lithography equipment—critical for semiconductor manufacturing—to China.

The administration of President Joe Biden has continued the effort to strengthen the US export control regime by attending to regulatory loopholes through a series of export control packages. Biden has also tried to improve the effectiveness of export controls against China by engaging allies and partners in a multilateral collaborative approach. While this coalition-building attempt caused initial frustration for the Netherlands and Japan due to economic costs and lack of consultation, it ultimately reduced opportunities for Chinese entities to exploit regulatory gaps by increasing enforcement consistency across key technology producing nations.

Another round of controls announced this week builds on this approach with a more targeted scope shaped by lobbying from the semiconductor industry and negotiations with the Netherlands and Japan. The measures balance national security priorities against economic interests of allies and industry stakeholders.

To sustain this progress, the Trump administration will need to focus on two priorities: ensuring export control compliance from companies that rely on revenue from Chinese markets to drive innovation; and maintaining collaboration with allies to strengthen enforcement and close regulatory gaps.

Ensuring compliance from companies will require the Trump administration to build on mechanisms that deter violations while offering incentives for adherence to regulations. Compliance could be improved by clearer regulatory guidance paired with strict penalties for non-compliance and by initiatives to offset financial losses for companies reducing dependence on Chinese markets. Focusing on ways to maintain the economic viability of businesses while implementing strict export controls will be critical in protecting the competitiveness of the US technology industry.

The Trump administration could also deepen technical cooperation with allies through such mechanisms as joint regulatory frameworks and synchronised licensing procedures. Rapid coordination in these areas would prevent adversaries from exploiting delays or disparities between national systems, ensuring export controls deliver their intended impact effectively.

Recent Five Eyes cooperation on export control enforcement, primarily targeting Russia, demonstrates how intelligence sharing between allies is being used to prevent the exploitation of loopholes. Expanding this effort to focus on countering Chinese attempts to subvert export controls would create a more robust enforcement framework.

Additionally, facilitating joint investments in semiconductor manufacturing and critical minerals processing in allied nations could reduce global dependency on China while bolstering supply chain resilience. Offering alternative market opportunities in trusted nations would further incentivise domestic companies to comply with export controls and improve relations with allies.

Australia’s position as a leading supplier of critical minerals, including rare earths, places it at the center of potential economic security considerations. In a second Trump term, Australia may face heightened expectations to further restrict Chinese direct investment in critical-minerals projects. Opportunities to increase trade with likeminded partners and fortify allied supply chains can be facilitated through existing partnerships, notably AUKUS and the Quad, which both prioritise economic and strategic collaboration to counter shared challenges posed by China.