Workers putting together financial plans for their retirement years rely on monthly Social Security payments as a big part of their income strategies.

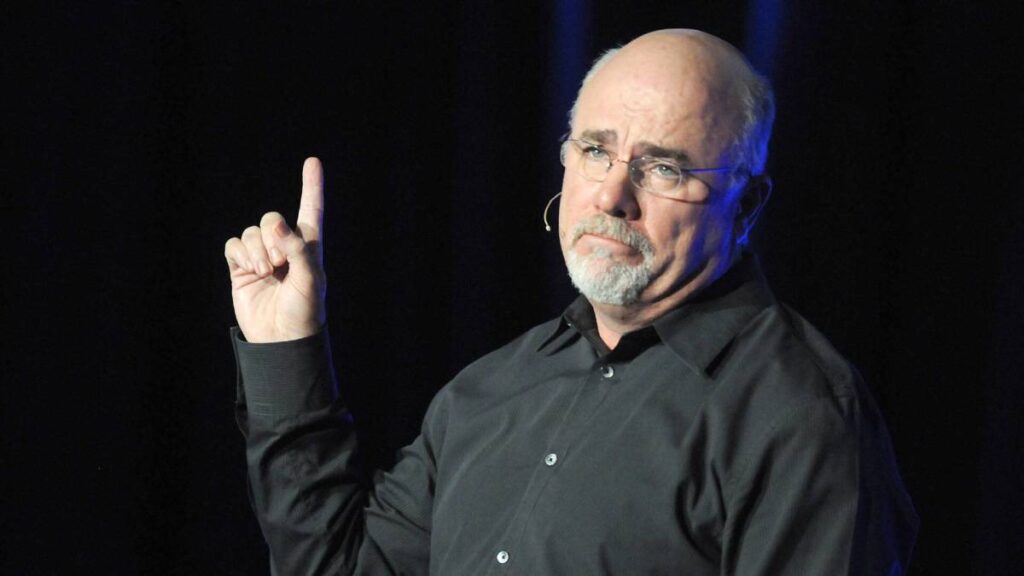

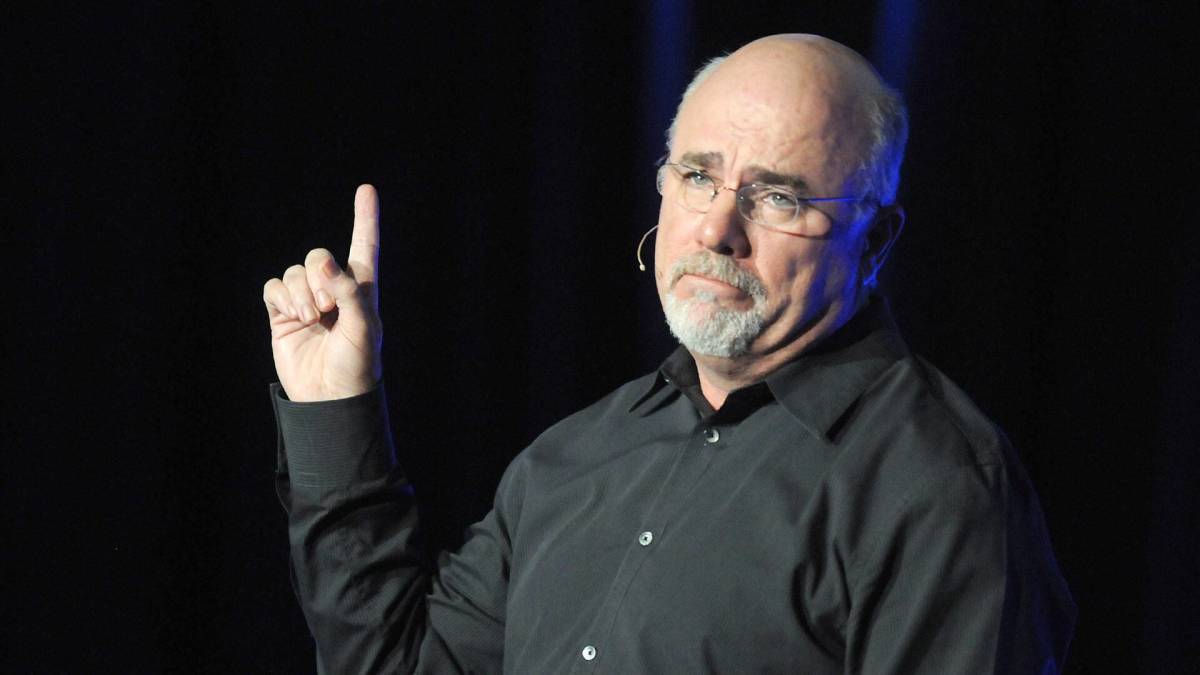

Personal finance radio host Dave Ramsey explains how those monthly checks should only account for part of one’s retirement income — and points toward a potential problem that needs to be considered.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

Broadly defined, Social Security benefits are payments that one receives after he or she retires (or becomes disabled).

People pay taxes during their working years to fund the federal program that, in turn, pays them a monthly amount when they are no longer working.

The Social Security tax rate is 12.4% in 2024. But Ramsey emphasizes the fact that one should not think of those taxes as being saved to fund their own retirement.

Rather, the Internal Revenue Service (IRS) collects those taxes and uses that money to send paychecks to current Social Security beneficiaries.

When a current worker paying those taxes eventually retires, they will then receive payments with money paid by the taxes of others who are currently working at that time.

Ramsey explains an important fact to consider, however, regarding the increasing number of Social Security beneficiaries compared to the number of current workers that are paying into the system.

Shutterstock

Dave Ramsey looks at the Social Security math

Currently, Ramsey explains, the benefits that one Social Security recipient receives are paid for by the taxes of 2.7 workers. But the number of workers per beneficiary is growing smaller as more people retire and live longer lives.

In fact, by 2035, the Social Security Administration (SSA) says that the number of beneficiaries is expected to grow from 61 million to 77 million.

When that happens, the number of workers per beneficiary will decrease to just 2.4.

More on Dave Ramsey

- Dave Ramsey sounds alarm on Social Security for retired Americans

- Dave Ramsey has blunt words on Medicare for retirees

- Dave Ramsey has a warning for people buying a home now

“Uh-oh,” Ramsey wrote. “Now you can see why the math on Social Security makes a lot of folks nervous.”

A Social Security report details how the program is only fully funded until 2034. At that point, its trust funds are expected to become depleted.

Unless legislative action is taken in Washington, this would result in a reduction of recipients’ paychecks to about 80% of their current values.

Related: Dave Ramsey warns Americans on Social Security and 401(k)s

Dave Ramsey explains the average Social Security payment

The SSA says the average 2024 monthly retirement benefit is $1,907.

“That adds up to around $22,900 each year,” Ramsey wrote. “No matter how you slice it, that’s not a lot to live on.”

The SSA also reports that more than 12% of retirees depend on Social Security paychecks for 90% or more of their income.

Ramsey emphasizes that the main portion of one’s retirement income should come from savings and investments that a worker makes during the course of their career.

The Ramsey Show host recommends that workers save 15% of their income for retirement, and that they begin doing so as early as possible. This is best done by combining savings from an employer-sponsored 401(k) and a Roth IRA.

“Your 401(k) and Roth IRA should be the foundation of your retirement plan and your main source of income in retirement — not Social Security,” Ramsey wrote.

Another important fact to consider is that Americans are able to apply for Social Security benefits from age 62 to age 70. Full retirement age is 67 for anyone born in 1960 or later.

The longer one waits to claim Social Security benefits, the more the dollar amount of their monthly checks will increase.

Related: Veteran fund manager sees world of pain coming for stocks