Swappable electric-vehicle batteries are gaining interest in Germany, with 63% of surveyed citizens viewing them as a better – or much better – alternative to fixed batteries, according to a survey of 2,500 participants.

The findings highlight growing dissatisfaction with the country’s existing charging infrastructure and a search for solutions to revive Germany’s sluggish EV market. Notably, only 19% of the study’s respondents expressed a negative opinion of battery swapping, while the remainder were undecided.

Participants were asked: “Manufacturers of electric vehicles are adopting swappable batteries. When a battery is depleted, it can be replaced with a fully charged one at a specialized service station. How do you view this system compared to electric vehicles with fixed, non-swappable batteries?”

One participant commented: “I don’t want to wait an hour or more to charge my car on a road trip. Swapping batteries makes so much sense – it’s like filling up a gas tank.”

Advantages of Swappable Batteries

Swappable batteries are claimed to provide more than quick energy replenishment. Lower charging voltages at dedicated swap stations are also said to extend battery life, while integrated diagnostics during swaps are designed to ensure better safety compared to high-voltage charging piles.

“A big advantage is that batteries can be regularly monitored and maintained,” explained Robin Zalwert, a mobility expert at survey sponsor TÜV, Germany’s equivalent to the U.S.’s National Highway Traffic Safety Admin.

Economic benefits also resonate with some. A survey respondent noted: “A car without a fixed battery would be more affordable for me. Leasing a battery makes it easier to upgrade later without buying a new car.”

Removing the battery cost from a new EV can lower its purchase price by around 20%, according to industry estimates. Additionally, separating battery ownership simplifies resale by emphasizing vehicle condition rather than battery health.

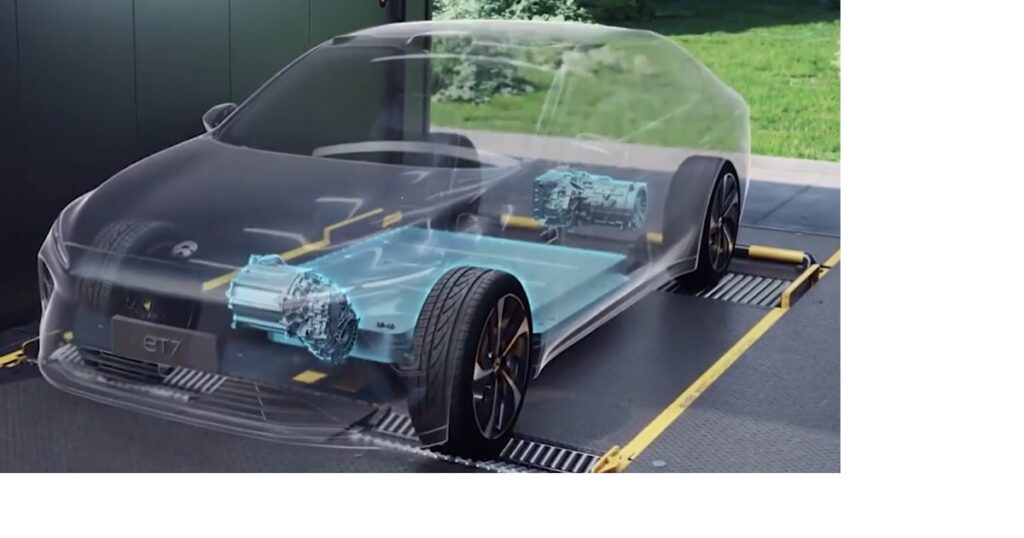

NIO and the Battery Swapping Ecosystem

Chinese automaker NIO, a leader in battery swap technology and services, operates over 2,741 EV battery swap stations in China – 903 of which are located along highways – and has established 14 stations in Germany as part of its European expansion.

Details released by the company revealed its Chinese network provided 2,318,053 swaps in November, averaging 77,268 swaps per day. NIO claims each swap takes around three minutes, saving users an average of 3 hours and 48 minutes per month compared to conventional charging methods.

Between January and November, NIO added 424 swap stations to its Chinese network.

Among the Chinese automakers cooperating with NIO on battery swap technology are Changan, FAW, GAC, Geely, JAC, Ji Yue and Lotus Technology.

Challenges in the German Market

The growing interest in swappable batteries comes as EV sales in Germany show signs of decline. Passenger vehicle registration data for November revealed a 21.8% year-on-year drop in EV registrations, with 35,167 units sold, representing 14.4% of total registrations – a decrease from 18% in November 2023.

Despite consumer support, battery swapping faces hurdles, such as the lack of standardization across automakers. TÜV’s Zalwert emphasizes that industrywide collaboration could reduce infrastructure costs and make swapping stations more viable. Meanwhile, emerging technologies like solid-state batteries and ultra-fast charging remain strong competitors, further complicating the evolving EV landscape.

Additionally, building and maintaining a network of swap stations is capital-intensive and may not achieve cost-efficiency unless a large number of EVs adopt the technology. Swappable batteries require modular designs, which can lead to compromises in vehicle design compared to fixed batteries optimized for space and efficiency.There are also concerns about long-term battery availability and compatibility, as advancements in cell chemistry may render older swappable batteries obsolete, leading to potential logistical and environmental challenges.