-

Image Credit Tourism Economics

Major airlines have recently lowered their earnings projections due to economic shifts and concerns about trade policies. This, combined with a significant drop in consumer confidence, suggests potential challenges for the travel industry, prompting questions about the impact on online travel giants.

Several major airlines, including Delta Air Lines, American Airlines, Southwest Airlines, and United Airlines, have recently revised their earnings forecasts downwards due to global economic fluctuations and trade policy tensions. This, coupled with a significant drop in consumer confidence, paints a potentially challenging picture for the travel industry and raises questions about the potential impact on online travel giants.

According to Stephanie Guichard, a senior economist at The Conference Board, this drop in consumer confidence was the most significant since August 2021. The United States Federal Reserve has also noted an increase in economic uncertainty. These developments have led to concerns about the potential significant impact on the travel industry.

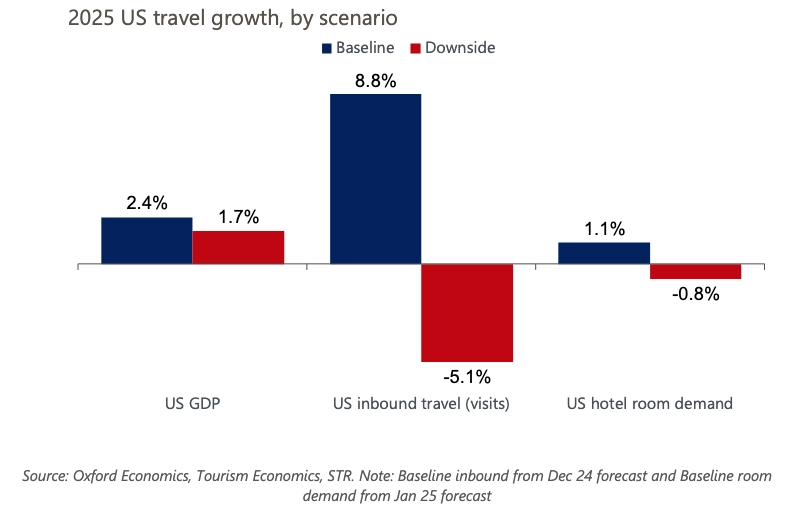

A report by Tourism Economics considered the potential impact of expanding trade wars, assuming substantial tariffs on Canada, Mexico, and China by the U.S. administration. The report also considered a loss in European travel sentiment due to tariffs and apprehension around the handling of Russia in Ukraine. The report suggests a potential decline in U.S. inbound visits by 5.1% and hotel room demand by 0.8% compared to the projected 8.8% and 1.1% growth in the baseline scenario, respectively.

Furthermore, the report estimates U.S. inbound travel spending to be 10.9% below the baseline outlook, indicating an estimated loss of $18 billion in 2025. Combined domestic and inbound U.S. travel spending is expected to be 3.7% below baseline, marking an estimated $64 billion loss in spending in the same year.

The report’s findings come at a time when several countries, including the United Kingdom, Denmark, Finland, Germany, and Canada, have issued travel warnings to their citizens about traveling to the U.S. due to instances of European travelers being detained at U.S. borders.

The current travel industry environment is causing concern, according to Tom Fitzgerald, Vice President of TD Cowen, who leads coverage of airlines. He suggests that the decline in sentiment could cause consumers to scale back discretionary spending and businesses to hold back on investment.

Notwithstanding these factors, Jake Fuller of financial services firm BTIG, notes in a recent report that while airline warnings have elevated concerns, it is not definitive that online travel agencies (OTAs) are in trouble given the current economic state. OTAs like Expedia Group, which has a more significant U.S. presence, might face more risk than companies like Airbnb and Booking Holdings with a broader global presence.

It is not clear whether the current economic downturn is an indicator of a long-term trend. However, a generally healthy economy and Americans’ propensity to prioritize trips and experiences could offset potential negative trends like a lack of consumer confidence.

Despite the current economic pressures, potential positive factors could include an easing of trade tensions, better-than-anticipated macro data, positive guidance from airlines on Q1 earnings calls, and indications that discretionary spending is not falling. It will take several months to see the impact of tariffs on prices and consumer pocketbooks. If the stock market recovers and prices stabilize, consumers may regain confidence in spending.

Discover more at PhocusWire.