-

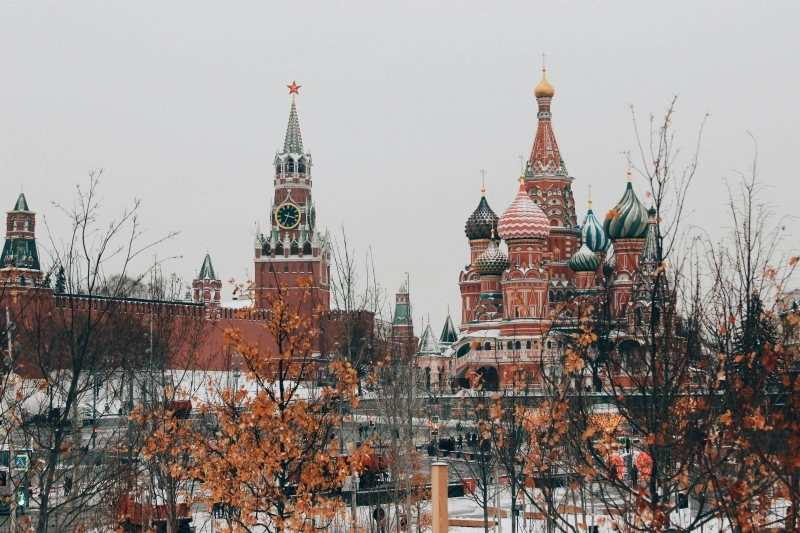

Russian Hospitality Industry Grapples with Labor Shortage Amid Rising Domestic Demand – Image Credit Unsplash

- Russia’s hotel industry is facing a severe labor shortage, which is affecting service quality and straining existing employees.

- Despite these challenges, the industry is experiencing a surge in domestic demand due to visa restrictions and a lack of direct flights to Europe.

The hospitality industry in Russia is experiencing a significant labor crisis despite a steady wave of domestic demand. According to the Russian Academy of Science’s Institute of Economics, the country is short of nearly 5 million employees across all sectors, predicted to persist in 2024. The labor shortage is affecting not only the quality of service in hotels but also increasing the workloads of existing employees, leading to potential burnout.

Hotel industry leaders, like Marianna Neumann, general director of the Dom Boutique Hotel in St. Petersburg, and Olga Kiseleva, general director of the Admiralteyskaya Hotel, have highlighted the labor shortage as a key challenge. They note that the industry cannot match the high salaries offered by other sectors, leading many potential employees to choose jobs in industries like e-commerce.

In addition to the labor crisis, Russian hotels are grappling with a rising fiscal burden. The Russian Central Bank’s decision to raise interest rates by two points to 21% to tackle inflation has made commercial loans nearly unaffordable for hoteliers. Furthermore, increasing property taxes and a recently introduced tourism tax add to the industry’s financial strain.

Despite these challenges, domestic demand for hotel services remains strong. Visa restrictions and a lack of direct flights to Europe have led to a surge in domestic travel, with many Russians choosing to vacation within the country. Data from CoStar indicates a year-over-year increase in occupancy among brand-affiliated hotels in Moscow and Saint Petersburg, with average daily rates and revenue per available room also significantly increasing.

The Russian hotel and travel industry is also witnessing shifts in its international inbound tourism, with countries in Asia and the Middle East now comprising the largest feeder markets. Despite the challenges, the Russian government aims to boost the inbound tourism flow to 6.5 million visitors annually, focusing on attracting visitors from China, Iran, and Saudi Arabia.

The situation has led to strategic changes in the industry, with hotel projects commissioned primarily in the Southern Federal District, including Sochi and Krasnodar Krai, as investors and hoteliers adapt to the changing landscape.

Visit CoStar for more details.